Sometimes, politicians have to eat shit for the health of the nation. And the massive bank bailout known as the Troubled Asset Relief Program, or TARP, was the biggest pile of shit on a plate this side of the Cheesecake Factory. With the housing bubble burst and the economy in freefall—credit frozen, foreclosures rising, the stock market plummeting—the government was compelled to essentially cut a $700,000,000,000 blank check to the banks (of borrowed money, with virtually zero restrictions) in order to stave off catastrophe. In order for the legislation to pass, politicians had to convince voters that the very same people responsible for torpedoing their pensions, 401k’s, property values, et al. would be the ones to receive hundreds of billions in their taxpayer dollars. Whether or not you agree with the decision to pass TARP, you have to admit that casting a vote in favor of the bill is politically unsavory. And casting politically unsavory votes are not something politicians do lightly.

Based on the popular book by New York Times financial columnist Andrew Ross Sorkin, the new HBO movie Too Big To Fail expresses the white-knuckle urgency of the 2008 economic crisis and the powerful men and women (mostly men) who worked to limit its destructiveness. Of course, white-knuckle urgency isn’t easy for a film about complex economic maneuverings to get across, and the parade of tense meetings in lavishly appointed boardrooms and offices aren’t likely to quicken the pulse of viewers who aren’t already engaged by the subject. (For a good primer, I always recommend “The Giant Pool Of Money,” which caused such a sensation when it aired on PRI’s This American Life that its reporters spun off into the Planet Money economic team. Michael Lewis’ book The Big Short is also aces.) But with the dumbed-down likes of Wall Street: Money Never Sleeps out there, not to mention the persistent oversimplification of media sources, I appreciated the wonkiness of Too Big To Fail, which respects its audience’s ability to process complicated information—and a lot of it, too.

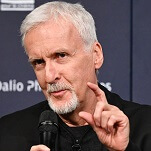

Covering the brief but terrifying period from the collapse of Lehman Brothers to the passage of TARP—mid-to-late September 2008, roughly—director Curtis Hanson (L.A. Confidential, Wonder Boys) and screenwriter Peter Gould attach themselves to Bush-appointed Treasury Secretary Hank Paulson and reveal the developments through his perspective. Though William Hurt lacks Paulson’s physically imposing height, he more than adequately captures the sick dread of a man who’s primarily responsible for preventing a financial apocalypse. Paulson’s central role in TARP has tagged him as a villain in some corners—the ultimate insider, funneling unseemly billions in taxpayer money to his cronies on Wall Street. But the film takes a more sympathetic view of a man who was placed in a terribly stressful situation and forced to improvise his way out of it, often looking like a fool in the process. Paulson doesn’t come across as heroic, exactly—he misreads the impact of allowing Lehman to fold, issues the blueprint for TARP in an insultingly slim three pages, and badly misjudges TARP’s impact on lending practices—but Too Big To Fail at least gives him credit for engaging with the crisis as well as he could and eating all the shit that implies.

Too Big To Fail surrounds Hurt with an absurdly overloaded cast of character actors, but only a handful make a strong impression. Best among them is Paul Giamatti, uncanny as Federal Reserve chairman Ben Bernanke, who quietly influences Paulson to follow the path of his choosing. There’s gravity to Giamatti’s performance but a subtle wiliness, too; while Paulson and the various financial industry titans hold panicked meetings and scream into their cell phones, his soft-spoken self-assurance makes him the true power behind the scenes. Billy Crudup is also terrific as the blunt (and appropriately runty) Timothy Geithner, who was president of the New York Federal Reserve at the time and would go on to take Paulson’s job for President Obama.

The rest of the cast—including blink-or-you’ll-miss it turns by the likes of Bill Pullman, Matthew Modine, and Dan Hedaya—mostly exists to carry information across. Though the stakes could hardly be higher, Too Big To Fail can only be so gripping, given the monumental task of simply clarifying what the hell is happening. (One particularly clunky scene has Paulson and three aides discussion the AIG situation in his office, each trading expository lines on credit default swaps, subprime mortgage bundles, and other such soupy concepts.) But there’s a nerdy integrity to the film that’s noble and, in the end, quite persuasive: Without taking an partisan position on what happened—only the last shot and subsequent titles tip its hand—Too Big To Fail simply and clearly explicates a chilling moment in recent history. And for that, it has value.